The Resource Centre for Human Rights and Civic Education (CHRICED) has condemned the Federal Government’s approval of a massive debt waiver for the Nigerian National Petroleum Company Limited (NNPC Ltd), amounting to $1.42 billion and N5.57 trillion owed to the Federation Account.

The centre on Monday said that this unprecedented write-off, executed through executive fiat, without public scrutiny, legislative approval, or accountability for those responsible, represents a grave assault on transparency, fiscal discipline, and constitutional governance.

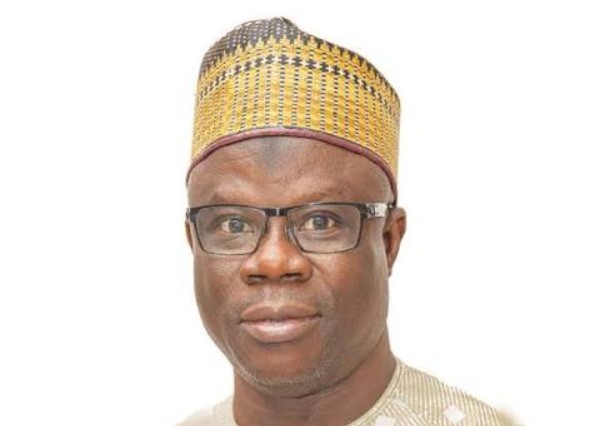

Executive Director of CHRICED, Dr. Ibrahim M. Zikirullahi who said that the development is a dangerous precedent in a time of revenue crisis, queried the Federal Government’s decision to cancel 96% of NNPC’s dollar-denominated debts and 88% of its Naira-denominated obligations effectively deprives the Federation Account of revenues meant to be shared among the federal, state, and local governments.

According to him, this fiscal giveaway comes at a time when the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) is underperforming its 2025 revenue target by over N5.65 trillion cumulatively; and in which in November 2025 alone, NUPRC recorded a N544.76 billion revenue shortfall, including a N538.92 billion gap in royalty collections.

“Writing off trillions of naira in receivables amid such alarming revenue deficits is not only irresponsible -it contradicts the government’s repeated claims of plugging leakages and strengthening public finance management,” Zikirullahi said.

While saying that NNPC Ltd’s “Commercial Autonomy” is now in question, the CHRICED boss said that under the Petroleum Industry Act (PIA), NNPC Ltd is expected to operate as a commercially driven entity governed by strict corporate standards.

He said, “However, forgiving trillions of naira owed to its sole shareholder—the Nigerian people—undermines this claim and exposes the company’s continued political insulation. This decision sends a troubling message to investors, development partners, and credit rating agencies: Nigeria’s fiscal governance remains unpredictable, discretionary, and vulnerable to political interference.”

Zikirullahi therefore called for the immediate public disclosure of the full reconciliation report and justification for the debt waiver, including the roles of all officials involved; an independent forensic audit of NNPC’s historical and current financial obligations, with findings made public; and legislative intervention by the National Assembly—especially its petroleum, finance, and public accounts committees—to investigate the circumstances surrounding the cancellation.

Also is the comprehensive accountability that includes civil servants, regulators, and private sector collaborators—not just token prosecutions of a few political figures; protection for whistleblowers and petitioners, ensuring that investigations are not quietly buried; and reform of FAAC governance, ensuring that decisions affecting federation revenues cannot be taken unilaterally by the executive.

“The government cannot demand fiscal discipline from citizens while secretly forgiving trillions owed by powerful institutions. True reform in the oil sector requires transparency, accountability, and justice—not accounting gimmicks or politically motivated write-offs.

“Until those who looted, enabled, or concealed these financial crimes are held accountable, decisions like this will only deepen public distrust and reinforce the perception that Nigeria operates a system where impunity is rewarded and accountability is optional,” Zikirullahi said.

Discover more from TheTimes Nigeria

Subscribe to get the latest posts sent to your email.